Do what you can, with what you have, where you are.

— Theodore Roosevelt

Your first step towards the journey of taking control of your personal finances. First, you need to know what you have and where it’s at. Allllll of it.

This are called your assets.

Oftentimes, we have more money than we think, simply because that money is scattered in various accounts from various seasons in our lives. You can’t make sound financial decisions until you know exactly where you stand.

So, your first task is to gather all account information into one spot. Depending on your situation, this make take time, may require phone calls, or hunting down information. When I first started this task, I had to remake passwords for bank accounts I never checked, and call my mother to find a binder in her house that contained some savings bonds information that my grandparents gifted me 20 years ago.

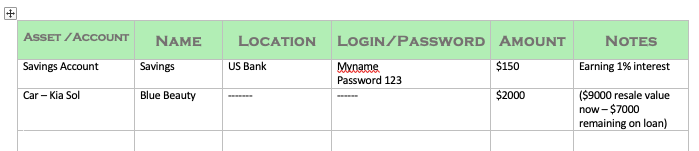

You are going to record every single account, as well as add up your valuable assets such as a car or house. For this first step, we will not be considering any debt owed or monthly expenses. Later, we will calculate your net worth, but this first step is focused on your assets only.

The checklist below will give you some ideas, but may not include everything that applies to your situation. Record all of your account and asset information – download the free checklist below to get started!

The FREE spreadsheet is linked below – it will download as a PDF. Below is an example of how to record your information. After you get done (it could take a while – stick with it!), TOTAL IT UP! The best part is the final box. Add up all of your “Amount” column to total your assets.